What is Day-Ahead Trading of Electricity?

Definition

Day-ahead trading of electricity refers to the buying and selling of electricity on the day before the actual production and delivery. Day-ahead trading either takes place on the spot market of the respective power exchange (often called day ahead market or day ahead auction) or through bilateral contracts between two parties - usually power trading companies - outside of the power exchange in over the counter (OTC) deals.

Why is Electricity Traded on a Day-Ahead Basis?

In many liberalized power markets worldwide, power traders, utilities, and often also large industrial or commercial power consumers need to balance their electricity production and/or consumption or that of their customers on a daily basis in order to even out their portfolio. They do so in an account which is often called a balancing group.

The owners of these balancing groups are called balancing responsible parties (BRP) and they need to make sure that the balancing group - the amount of electricity sold/consumed and bought/generated - is always evened out. When ensuring long-term balancing (and risk-mitigating hedging) of their portfolio, balancing responsible parties usually use the futures markets of the respective power exchange. There, they buy or sell electricity for the next months or even years to balance their balancing group well ahead of the time of delivery.

The closer the day of actual delivery of electricity comes, the more fine-tuning of the balancing group is needed - a still existing surplus or shortage of electricity in the own balancing group needs to be erased. For this, the balancing responsible party uses trades or OTC contracts on the day-ahead market. After the auctions on day-ahead markets are closed, existing shortfalls or surpluses can still be evened out through intraday trading.

Example for Day-Ahead Trading

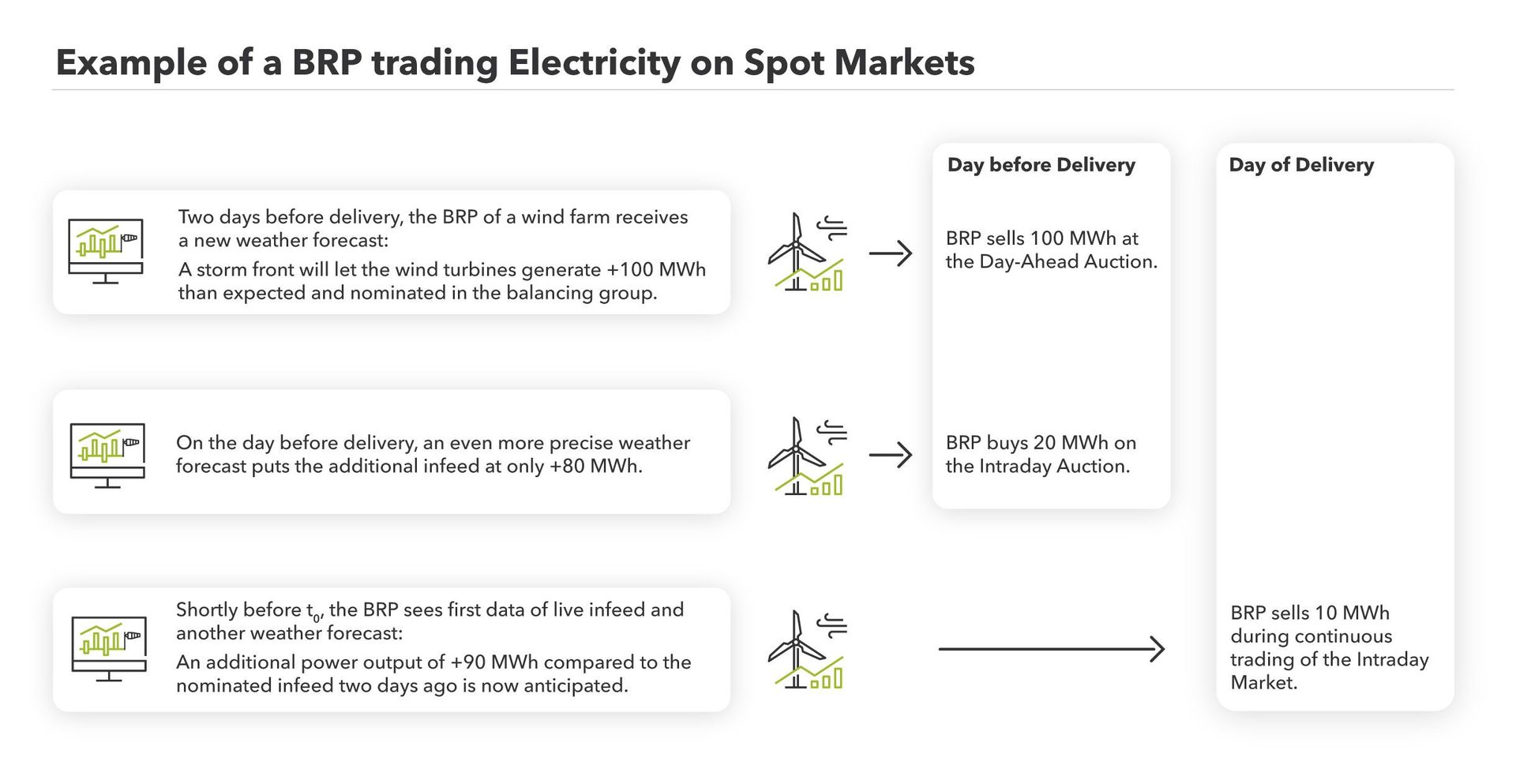

The operator of a large wind farm has contracted an electricity trader to assume the role of the balancing responsible party for all the electricity that is generated by the wind farm. The largest chunks of that quantity is sold through a power purchase agreement (PPA) to an industrial consumer.

Now, the quantity of electricity generated by the wind farm fluctuates on a daily, even hourly basis. In order to zero out these fluctuations, the BRP - the electricity trading company in this example - uses weather forecasts and live data from the wind farm to forecast the actual amount of power that will be generated by the wind farm at any given time. Let’s assume an unexpected wind front is scheduled to hit the wind farm tomorrow: Now the trader needs to sell the forecasted surplus electricity from that wind farm - the amount that is not covered by the PPA - in order to have a clean balance sheet. The trader will then sell that power on the day-ahead market, and the power will be bought by another party that has a shortage in its balance sheet.

On the following day, the wind front is even stronger than expected on the day before and generates even more surplus electricity. This additional quantity, that is neither covered by the PPA nor by the day-ahead trades, can be sold on the intraday market.

How is Day-Ahead Trading Conducted?

The rules for day-ahead trading differ vastly from one national market to another. These differences relate to lead times, trading intervals, minimum tradable quantities, pricing in the auction process, gate closures, and many more specifics.

More information on the workings of day-ahead trading on the two largest European power exchanges is provided by EPEX SPOT and NORDPOOL on their respective websites. Some Independent Service Operators in the USA also provide information on their day-ahead markets, e.g. PJM.

More to read

Development of Day-Ahead Trading in Recent Years

With an ever increasing level of liberalization in energy markets around the world and an ever rising penetration of fluctuating renewables in these liberalized markets, the role of the spot market (i.e. day-ahead and intraday trading) has become more and more important over the last decade. For example, the volume of day-ahead trading on EPEX SPOT for the market areas Germany, Austria, France, and Switzerland in 2011 was at 296 TWh; in 2020 this number already sat at around 411 TWh.

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.